Cheque Bounce Case under Section 138 of Negotiable Instruments Act (NI Act)

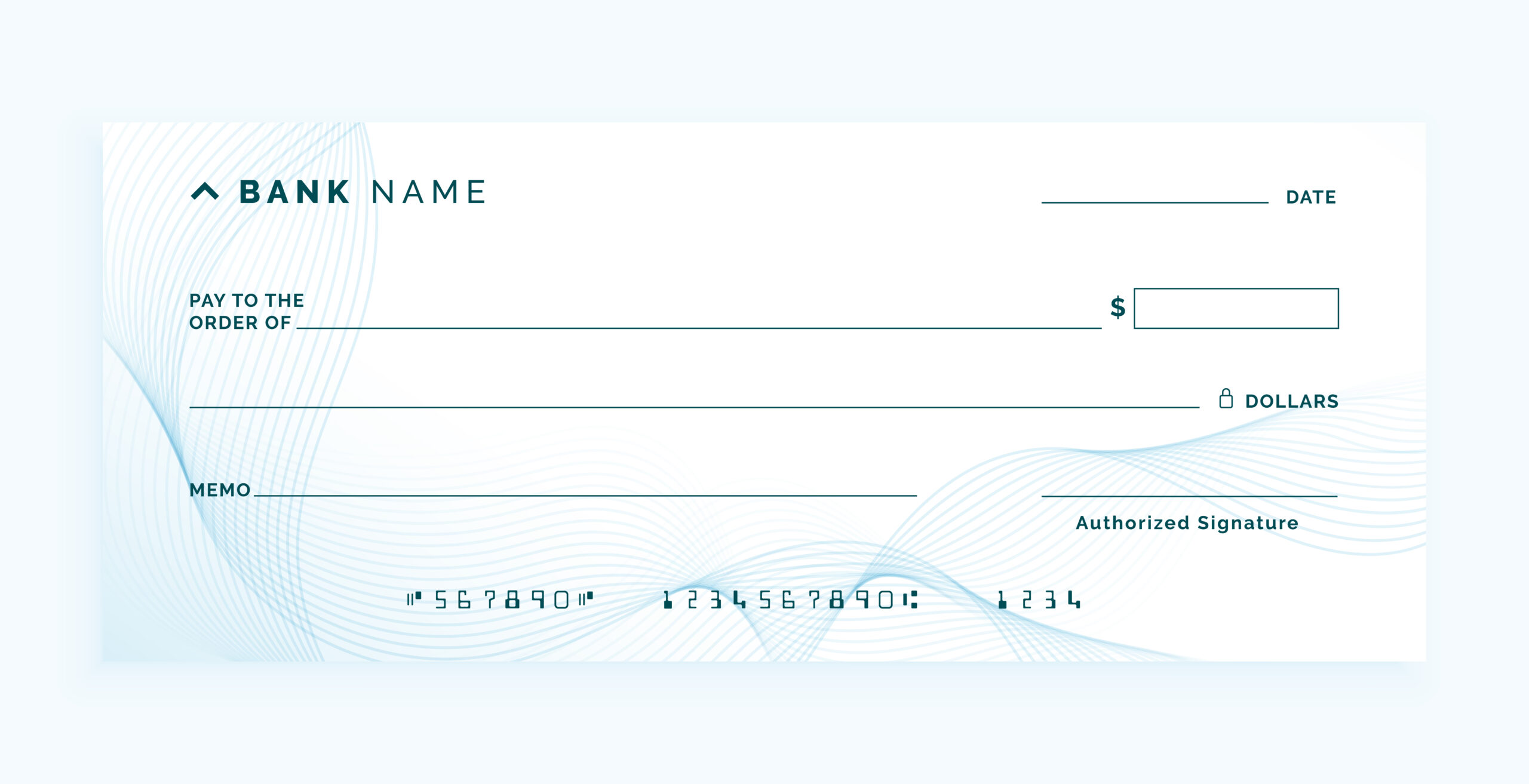

A cheque bounce case arises when a cheque issued by a person is returned unpaid by the bank due to reasons such as insufficient funds, account closed, payment stopped, or signature mismatch.

In India, cheque bounce is a criminal offence under Section 138 of the Negotiable Instruments Act, 1881.

What Is Section 138 of the Negotiable Instruments Act?

Section 138 provides legal remedy to the payee when a cheque issued towards a legally enforceable debt or liability is dishonoured by the bank.

If all legal conditions are fulfilled, the drawer (issuer of cheque) can be prosecuted.

Common Reasons for Cheque Bounce

- Insufficient funds in bank account

- Account closed by the drawer

- Payment stopped by drawer

- Signature mismatch

- Cheque validity expired

- Technical reasons

Legal Conditions to File a Case under Section 138

For a valid cheque bounce case, the following conditions must be met:

- Cheque must be issued for a legally enforceable debt or liability

- Cheque must be presented within 3 months from the date of issue

- Bank must return the cheque unpaid

- Legal demand notice must be sent within 30 days from the date of cheque return memo

- Drawer must fail to make payment within 15 days of receiving the notice

Procedure of Cheque Bounce Case (Step-by-Step)

Step 1: Cheque Presentation

The payee presents the cheque to the bank within validity period.

Step 2: Dishonour Memo

Bank returns the cheque with a return memo stating the reason for dishonour.

Step 3: Legal Demand Notice

Payee sends a written legal notice demanding payment within 15 days.

Step 4: Filing of Complaint

If payment is not made, a complaint is filed before the Judicial Magistrate within 30 days after expiry of notice period.

Punishment under Section 138 NI Act

Upon conviction, the court may award:

- Imprisonment up to 2 years, or

- Fine up to twice the cheque amount, or

- Both imprisonment and fine

Is Cheque Bounce a Civil or Criminal Case?

A cheque bounce case is primarily criminal in nature, but it also has civil consequences relating to recovery of money.

Can a Cheque Bounce Case Be Settled?

Yes. Cheque bounce cases are compoundable offences. Parties may settle the matter at any stage, including during trial, subject to court approval.

Important Supreme Court Guidelines

- Section 138 cases should be disposed of speedily

- Summary trial is preferred

- Courts may encourage mediation and settlement

Defences Available to the Accused

- No legally enforceable debt

- Cheque issued as security

- Notice not properly served

- Payment already made

- Cheque misused or stolen

Practical Tips for Cheque Issuers

- Maintain sufficient balance

- Do not issue blank cheques

- Record all payments

- Respond promptly to legal notices

Cheque bounce cases under Section 138 NI Act are serious legal matters with criminal implications. Both issuers and recipients of cheques must act carefully and within legal timelines to protect their rights.

DISCLAIMER

This content is purely for educational and informational purposes. It is not a promotion, advertisement, or solicitation. The information is for public awareness only. Cybercrime procedures and outcomes depend on the facts of each case.